Ohio History Journal

A HISTORY OF

BANKING AND CURRENCY IN OHIO

BEFORE THE CIVIL

WAR.

PREFACE.

In the following pages on the

development of banking and

currency in Ohio from 1803 to 1863 an

attempt has been made

to point out also some of the relations

of those subjects to the

general economic and political history

of the state.

The monograph had its origin several

years ago in the semi-

nary in business organization of

Professor Jeremiah W. Jenks

while the writer was a graduate student

in Cornell University,

and to Professor Jenks he is indebted

for many helpful sugges-

tions and discussions in planning and

prosecuting the work in

its early stages. To Dr. Charles H.

Hull, Professor of American

History, Cornell University, and to Dr.

Frank A. Fetter of

Princeton University, formerly Professor

of Political Economy

and Finance, Cornell University, the

author also owes a debt of

gratitude. Both of these gentlemen read

much of the manu-

script and their careful criticisms

proved of great value through-

out the study.

What began as an investigation of the

development of busi-

ness organization in Ohio prior to 1863

soon resolved itself into

a study of banks and banking, for during

that period banks were

the largest and the most numerous

representatives of the cor-

porate form of business organization in

the state. They were

the pioneers in big business in Ohio. It

has seemed proper to

treat the subject in two parts: first,

because authorized banking

almost ceased in Ohio between 1843 and

1845, as may readily

be seen from the diagram in the

appendix; second, because the

basis of note issue, the chief function

of a bank in those days,

was entirely different in Ohio before

from what it was after the

dates unamed; and finally, because at

that time the practice of

incorporating banks by special acts of

the legislature gave way

to the method of organizing them under general laws.

(235)

236 Preface.

In carrying on this study the Ohio state

documents and

the early newspapers and local histories

of the state have been

the most important sources of material

and this fact delayed the

completion of the work for some years

until the writer's return

to Ohio where alone much of this

material was accessible. In

making available the many state

publications and files of old

newspapers, which had to be gone through

without the help of

an index, great assistance has been

rendered by the staffs of the

Cornell and Ohio State University

Libraries and the Library of

Congress, Washington, D. C., the Dayton

Public Library, Day-

ton, Ohio, and the Ohio State Library,

Columbus, Ohio.

Others to whom the writer wishes to

acknowledge obliga-

tion are, Professor Davis R. Dewey of

the Massachusetts Insti-

tute of Technology, for assistance in

the collection of material

and approval of the completed monograph

as a part of the

Carnegie Institution's work on the

economic history of the

United States, and Mr. E. O. Randall,

Secretary of the Ohio

State Archaeological and Historical

Society, for his kindness in

reading the manuscript and his active

interest in furthering its

publication. Last, but not least, there is the debt which the

writer owes to his wife, for

encouragement and assistance in

the various stages of the work.

C. C. HUNTINGTON.

Ohio State University,

August 24, 1915.

CONTENTS.

PAGE

Preface ........................................................... 235

Table of Contents

................................................ 237

M ap of O hio

.................................................... 244

INTRODUCTION.

Geography and Early History of Ohio

............................. 245

Boundaries

and Drainage

....................................

245

La Salle and the French Fur Traders

......................... 245

English Trade Rivalry

....................................... 246

The Inevitable Conflict

....................................... 247

Pontiac's Conspiracy ........................................ 248

The Q uebec Bill

... ........................................ 249

The Moravians and the Squatters

............................ 249

Permanent Settlement ...................................... 250

The Treaty of Greenville

.................................... 251

Admission to Statehood...................................... 251

A HISTORY OF BANKING AND CURRENCY IN

OHIO BEFORE THE

CIVIL WAR.

PART I. BANKING IN OHIO UNDER SPECIAL CHARTERS.

1803-1843.

Note issue based on general assets.

CHAPTER I. THE ANTE-INFLATION PERIOD. 1803-1814.

Economic

Conditions ........................................ 255

Early M

anufacturing ........................................ 255

The M iami

Country.......................................... 256

The Miami Exporting Company (The First Bank)

........... 257

The Bank of Marietta

....................................... 260

The Bank of Chillicothe

..................................... 261

The Bank of Steubenville

.................................... 262

Other Banks Chartered

...................................... 263

Unauthorized Banking

...................................... 265

Conditions of the Ohio Banks prior to 1815

................... 266

CHAPTER II.

THE INFLATION PERIOD OF 1815-17.

Increase

of Population ..................................... 269

Economic Conditions

........................................ 270

Speculation and Inflation in the Mississippi Valley

............ 271

Governor Worthington on the Subject of Banks

.............. 272

The Bonus Law of Feb. 23, 1816

............................. 273

Banks Incorporated by the Bonus Law

....................... 275

Other Banks Chartered under Provisions of the Bonus

Law.. 276

Ohio Banks incorporated from Feb. 24, 1816, to Jan. 14,

1818.. 277

Statistics of Banking Capital

............................. .. 278

Suspension and Bank Note Depreciation

...................... 279

Convention of Ohio Banks at Chillicothe

...................... 282

Branches of United States Bank in Ohio and Resumption

of

Specie Payment ........................................

283

Proposition for a State

Bank................................. 284

(237)

238 Contents.

CHAPTER III. THE CRISIS OF 1818-19. PAGE

The Golden Age of the Western Country

..................... 285

Distribution of State Banks in the

United States, 1818 ........ 286

Causes

of the Crisis of 1818-19 ............................... 287

The Crisis in the West occasioned by the

U. S. Bank.......... 288

Expansion of Credit by Western Branches

.................... 288

Operations of U. S. Bank increase

Inflation in the West....... 289

Sudden Restriction of Credit by United

States Bank precipi-

tates

the Panic......

................................... 290

The United States Bank calls for

Balances from Cincinnati

Banks

........................................ 291

Suspension of Specie Payments by Ohio

Banks ................ 291

Notes of Many Ohio Banks refused at

State Treasury in Pay-

m ent

of T

axes.................................... .....

292

State Bank Notes refused at Cincinnati

in Payment of Public

Land Sales: Chartered Banks ask for the

Repeal of

Bonus

Law

................................. ....... . 293

Counterfeit Notes, Small Notes, Post

Notes, Buying up Notes

at Discount, and Tax on Unauthorized

Banks ............ 295

Specie Drained from Ohio by the United

States Bank......... 297

Fall of Prices in Ohio and the West

Generally ................ 298

Debt and Distress in the Mississippi

Valley ................... 298

Report of the Select Bank Committee of

the Ohio Legislature. 300

Recommendations of the Committee

......................... 300

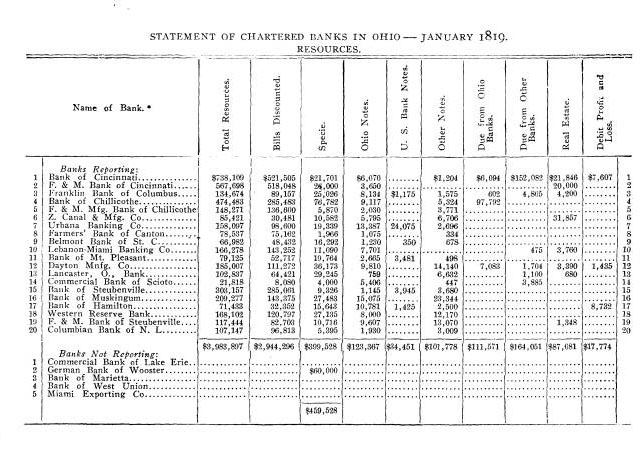

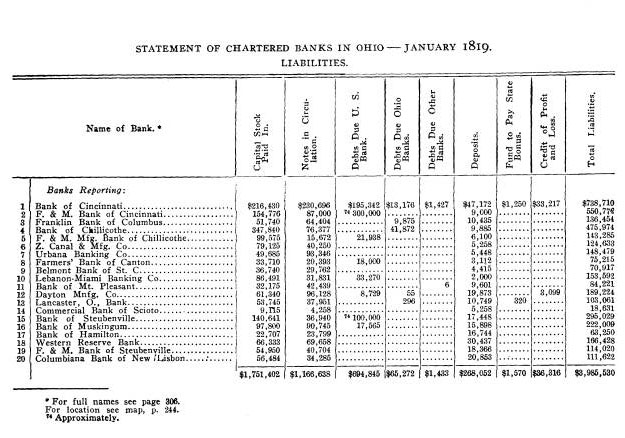

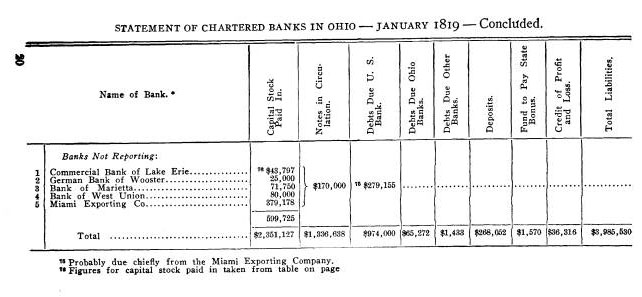

Condition of Chartered Banks in Ohio,

January, 1819........ 301

Table showing Condensed Statement of

Assets and Liabilities

of

Chartered Banks

.....................................

303

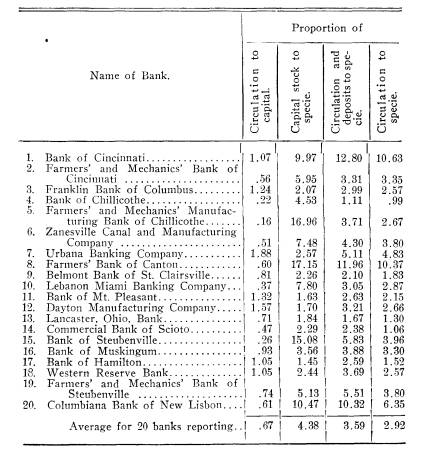

The Ratio of Circulation to Capital and,

the Proportion of

Capital, Circulation, and Deposits to

Specie for Chartered

Banks,

January, 1819

....................................

306

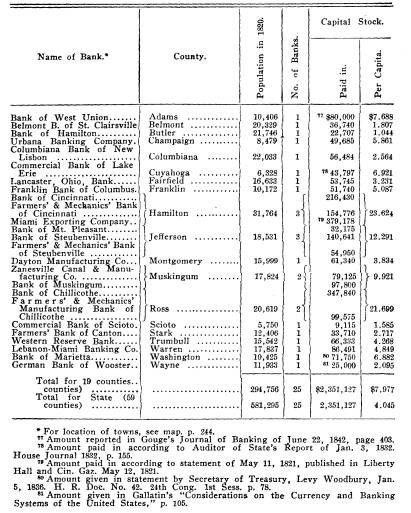

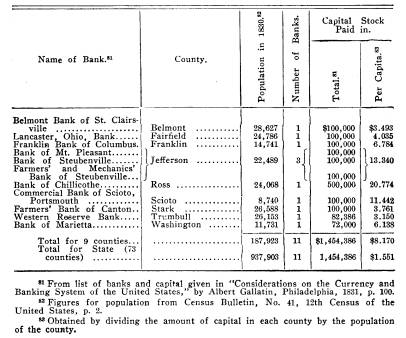

The Distribution of Ohio Banks by

Counties and the Propor-

tion of Capital to Population, January,

1819.............. 307

Statement of Bank of John H. Piatt &

Co., Cincinnati, March, 1819 309

Depreciation of Ohio Bank Notes in 1819

and 1820 ............ 309

Specie paying Banks of Ohio in 1820

.......................... 311

CHAPTER IV. THE ATTEMPT TO TAX THE BRANCHES

OF THE UNITED

STATES BANK.

Early

State Opposition to

the Bank ........................... 313

Report of Joint Committee of the Ohio

Legislature on the

Expediency of Taxing the Branches of the

U. S. Bank.. 314

Substitute Report.adopted by the Ohio

House of Representatives 315

Hostility to the Bank

increases in 1818 ........................ 316

Ohio enacts a Law taxing Branches of the

Bank in the State.. 317

The Case of McCullouch vs. Maryland

........................ 317

The State forcibly collects Tax from

Chillicothe Branch...... 318

Arrest and Trial of State Officials

concerned in Collecting the Tax 319

Excitement over the Affair

................................... 320

Ohio Elections in Fall of 1819 influenced

by Bank Fight....... 321

Contents.

239

PAGE

Hard

Times increase Hostility to the Bank .................... 322

Report

of Special Committee of the Ohio Legislature ......... 322

Recommendations

and Resolutions offered by the Committee.. 324

The

Ohio Legislature reaffirms the Kentucky and Virginia

Resolutions

and Outlaws the United States Bank ........ 324

The

Case of Osborn vs. The United States Bank ..............326

The

People of Ohio submit to the Decision of Supreme Court. 328

CHAPTER

V. PERIOD OF DEPRESSION AND RECOVERY, 1820-1830.

Depression

and Low Prices in the Early 20's .................. 330

Dullness

in Land Sales and Lack of Immigration into State.. 332

Bad

Banking and Depreciation of Ohio Bank Notes not the

Chief Cause

of the Depression .......................... 333

Lack

of Markets for the Surplus Products of the State....... 334

Opening

of the Erie Canal and Beginning of Ohio Canals, 1825. 335

Industrial

and Social Awakening in the State ................. 335

Dissatisfaction

with the Operation of the Bonus Law.......... 337

Difficulty

in Collecting State's Claims against Banks .......... 339

Tax

on Bank Dividends substituted for the Bonus ............ 340

Lack

of Banking Statistics from 1820 to 1830 .................. 341

Need

of Banking Capital in Cincinnati in 1826 ................ 342

State

Loans and Public Works increase the Money Supply..... 343

Project

of a State Bank Discussed ........................... 343

Two

New Banks authorized by the Legislature ................ 344

Depression

of Ohio Bank Notes in 1822 and 1828 ............. 345

Ohio

Bank Failures from Jan. 1, 1811 to July 1, 1830 .......... 346

Causes

of Failures of Majority of Ohio Banks ................ 347

Benefits

derived from surviving Banks ....................... 348

Distribution

of Banks and Capital in Ohio, January, 1830...... 349

Number

and Capital of State Banks in Ohio, 1805 to 1830.... 350

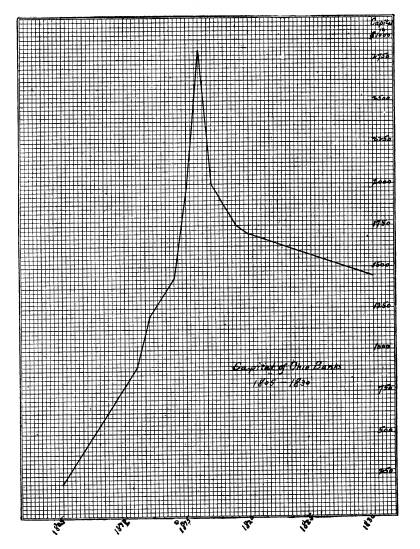

Diagram

showing changes in banking capital, 1805-30.......... 351

CHAPTER VI. THE SECOND PERIOD OF

EXPANSION. 1831 TO 1836.

An

era of internal improvements ............................. 352

Increase

in immigration ..................................... 352

Growth

of population in Ohio ................................ 353

Effect

of transportation facilities ............................. 353

Foreign

commerce and foreign loans .......................... 353

Period of business expansion

................................ 354

Excessive credit and speculation

.............................. 355

Rapid growth

of local banking ................................ 355

Refusal

to recharter U. S. Bank .............................. 355

Withdrawal

of public funds from U. S. Bank and their deposit

in

state banks .......................................... 356

Payment

of national debt, distribution of surplus among states 356

Relation

of credit and speculation ............................ 357

Rapid

increase of bank notes and other money in U. S........ 358

Bank circulation

in Ohio

..................................... 358

Charter

of Bank of Norwalk ................................ 359

240 Contents.

PAGE

Revival of

Dayton Bank .....................................359

Opening of

Commercial Bank of Cincinnati .................. 360

Tax on

dividends of banks increased to 5% ................... 360

Re-opening

of Commercial Bank of Lake Erie ................ 362

Scarcity of

money in Ohio .........

................ .

362

Revival of

project for State Bank ......................... 363

Two

million-dollar banks authorized in Cincinnati ............ 364

Message of

Gov. Lucas, Dec. 1833 ............................ 365

Banking

capital in Ohio held by non-residents ............... 365

Annual cost

of foreign banking capital to people of Ohio...... 366

Ohio bank

notes depreciated beyond vicinity of issuing bank... 366

Financial

disturbances early in 1834 .......................... 366

Defeat of

State Bank Bill .........

............. .

367

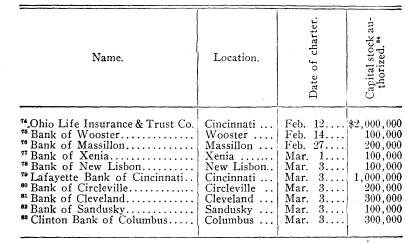

Ten more

local banks chartered in 1834 ............ ...

367

Clinton Bank

of Columbus organized by office-holders ........ 368

Capital

stock of new banks over-subscribed .................... 369

The Ohio

Life Insurance and Trust Co...................... 369

Revival of

Miami Exporting Co. and Urbana Banking Co...... 371

Number and

capital of Ohio banks in March, 1835 ............ 372

Ohio banking

statistics in 1835 ............................... 373

Proportion

of specie to circulation ......................... 374

Distribution

of banks by counties and ratio of capital to popu-

lation in

1835 ........................................... 375

Climax of

the inflation in 1836 ................................ 377

The

"No-Bank" Party in power .............................. 377

Report of

legislative committee against chartering more banks. 377

U. S.

Treasury Department urges states to suppress small notes 378

Governor

Lucas recommends prohibition of bills less than $5.. 379

Extent of

circulation of small bills .......................... 380

Banks asked

to give up vested rights to issue small bills....... 381

Replies of

the banks ........................................ 381

Law of March

14, 1836, prohibiting small notes ................382

CHAPTER VII.

THE PANIC OF 1837 AND THE RESULTING DEPRESSION.

1837-43.

The national

government tries to check bank note inflation ....384

The Specie

Circular

........................................ 384

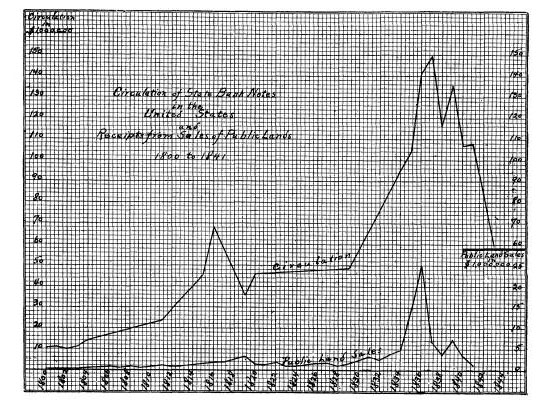

Relation of

bank note inflation to public land sales............ 385

General

suspension of specie payment ........................ 385

The Panic of

1837 ....................................... 387

Cause of

suspension of Ohio banks ...........................387

Ohio bank

convention, June 1837 .............................388

Statistics

of Ohio banks in 1837 ..............................388

Repeal of

law prohibiting small notes ........................389

Partisan

nature of the vote .................................. 390

Resumption

of specie payment .............................. 390

Statistics

of Ohio banks in 1838 ..............................391

Suspension

again in 1839 ................................... 391

The Bank

Commissioner Law ............................... 392

Contents. 241

PAGE

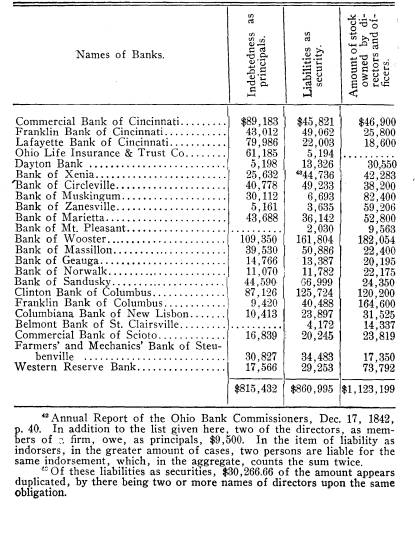

First annual report of bank commissioners

.................... 392

Indebtedness of directors and officers

......................... 393

Re-enactment of law forbidding small notes

.................. 395

Messages of Governor Shannon

.............................. 395

Message of Governor Corwin

............................... 396

Question whether to adopt State Bank or Safety-Fund

System. 396

Currency fluctuation in Ohio

................................. 397

Exports from Ohio in 1840 .................................. 397

Effect of internal improvements

.............................. 397

Canal receipts and shipments at Cleveland

.................... 398

Low

prices and hard

times ................................... 398

Agitation for new banking system in Ohio

.................... 399

Third annual report of bank commissioners

................... 401

Taxes paid by Ohio banks, 1831 to 1843

....................... 402

Difficulty in collecting taxes from banks

...................... 403

Bank failures in 1841-2

.....................................

403

Bank question in Ohio involved in party politics

............... 405

The general banking law of 1842 .............................. 405

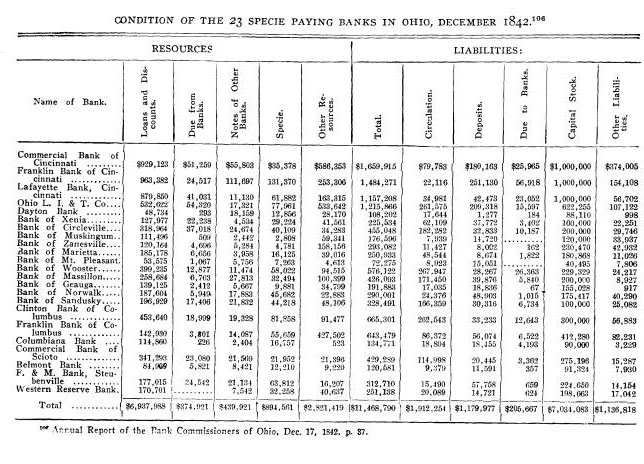

Statistics

of Ohio banks in 1842

.............................. 406

Expiration of charters of majority of Ohio banks in

1843...... 408

PART II. BANKING IN OHIO UNDER GENERAL LAWS.

1843 to 1863.

Note issue secured by safety fund or bond deposit.

CHAPTER VIII.

CONDITIONS PRIOR TO 1845.

Specie Paying Banks in Ohio in 1843 and 1844

................. 413

Economic

Conditions in the

State ............................

414

Exports and Exchange Operations

............................ 415

Foreign and Unauthorized Bank Circulation

.................. 416

Inadequate Banking Facilities and Low Prices

................ 417

Private

Capital in the

State .................................. 418

Objections to the General Banking Law of 1843...............

419

Agitation for a New Banking Law

........................... 420

Difference of Opinion as to System needed

................... 420

Kelley's Bank

Bill in the Legislature .......................... 421

CHAPTER IX.

THE STATE BANK OF OHIO AND INDEPENDENT BANKS.

1845-1851.

The General Banking Law of Feb. 24, 1845

................... 423

Provisions relating to the State Bank

....................... 424

Provisions relating to Independent Banks

.................... 425

General Provisions of the Law ... ........................ 425

Meeting of Board of Bank Commissioners

................... 426

Organization of the Board of Control

........................ 426

Formation

of New Banks .................................... 427

Effect of Increase in Banking Facilities

...................... 427

Opposition to the New Law in 1845 and 1846 .................

428

Increase of Bank Circulation and Prices

..................... 429

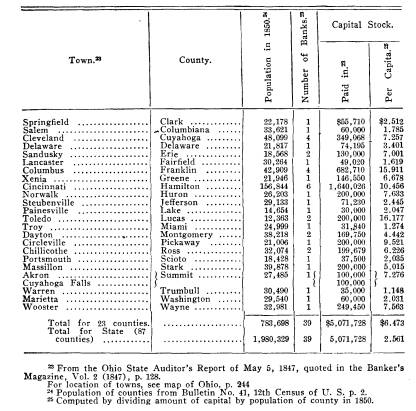

Distribution of Banking Facilities throughout the

State........ 430

242 Contents.

PAGE

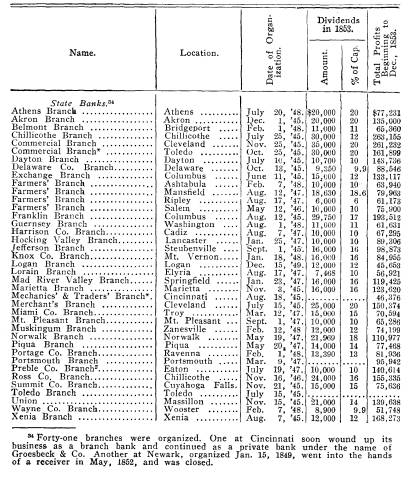

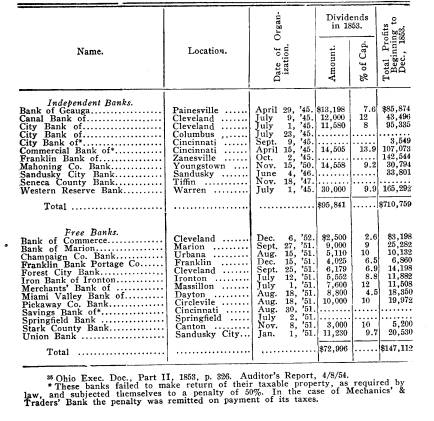

Statistics

of Growth of Banks under the General Law........ 431

CHAPTER

X. THE NEW CONSTITUTION AND THE FREE BANKING LAW

OF

1851.

Failure

of Old Banks ....................................... 433

Anti-Bank

Party again in Power................ ........... 434

The

Constitutional Convention ............................... 434

Bank

Reform in the Legislature ............................. 435

The

Free Banking Law of March 21, 1851 .................... 437

Free

Banks organized in 1851 and 1852 ....................... 438

CHAPTER

XI. BANKING AND CURRENCY CONDITIONS, 1851-1854.

End

of another Period of Bank Expansion ................... 439

Expansion

Period one of Business Prosperity ................ 439

The Profits

of the Banks

.................................... 440

Sources of Banking Profits

... ............................... 441

The

10% Interest Law of 1850 ............................... 442

Bankers

Interested in Broker Establishments .................. 443

Increase

of Private Banks and Broker Firms .................. 444

Failure

of Laws against Unauthorized Banking ............... 446

Demand

for more Banking Capital in Ohio ................... 448

Depreciated

Currency in the State ............................ 449

Schemes

to Avoid Redemption ................................ 450

The

Use of Banks for Deposits and Loans.................... 452

Bank Failures in1854

........................................ 453

Condition of Remaining Banks ............................... 454

CHAPTER

XII. BANK TAXATION IN OHIO BEFORE THE WAR.

Decline

in Banking Facilities attributed to Tax Laws......... 456

Taxation

of Dividends or Profits prior to 1850 ................ 456

Tax

on Capital and Surplus in 1850 and 1851 .................. 458

Opposition to Tax Law of

1851 .............................. 459

Tax on Loans and Discounts

................................. 459

Refusal

of Banks to Pay the Tax ............................ 460

The Crow

Bar Law of

1853 ..................................

460

Kelley's

Bank Tax Law of 1856 .............................. 462

Vacillating

Character of Rest of Period ..................... 462

CHAPTER

XIII. THE BANK OF OHIO, PANIC OF 1857, AND

NOTE RE-

DEMPTION

AGENCIES.

Further

Decline in Banking Capital in 1855 .................... 464

Act

to Incorporate the Bank of Ohio and Other Banks........ 464

Objections

to the Proposed Banking Law ..................... 465

Governor

Chase favors Free Banking ........................ 465

Another

State Bank Law rejected by the Voters .............. 466

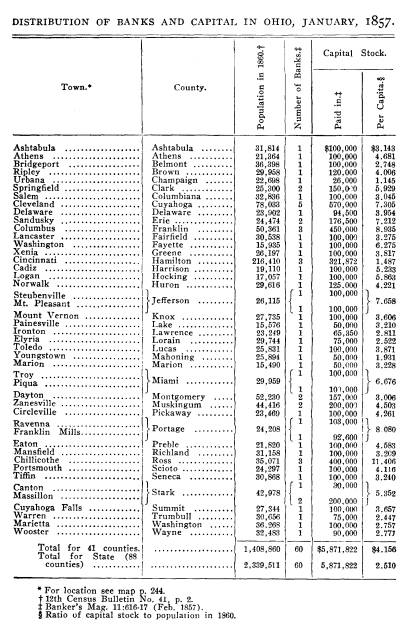

Distribution

of Ohio Banks in January, 1857 .................. 467

Industrial

Progress in Ohio, 1852 to 1857 ..................... 469

Failure

of Ohio Life Insurance and Trust Co ................. 470

The Panic

of 1857 ..

.......................................... 470

Failure

of Trust Company threatens State Bank of Ohio ...... 471

The

State Bank establishes a Note Redemption Agency........ 472

The Ohio

Bank Agency of

1850 ..............................

472

Contents. 243

PAGE

The Opportunity for

a Redeeming Agency .................... 473

The Agencies of 1854 and 1857 ............................... 473

Agitation for an Ohio

Valley Clearing House ................. 474

The Brokers' Assorting

System ............................... 474

The Bank

of the Ohio Valley ................................ 475

CHAPTER XIV.

CONCLUSION.

Majority of Ohio Banks

survive the Panic .................... 477

Many Ohio Banks become

National Banks after 1863 .......... 478

End of Period of Note

Issue under General Ohio Laws....... 478

Classes of Ohio Banks

under General Laws ................... 479

Division of Banks

according to Security for Note Issue...... 480

Objection to Safety

Fund Security ............................ 480

Comparison of State

Bank of Ohio with that of Indiana...... 481

Comparison of State

Bank of Ohio with New York Safety

Fund System

........................................... 481

Comparison of State

Bank with Stock Banks .................. 483

APPENDIX.

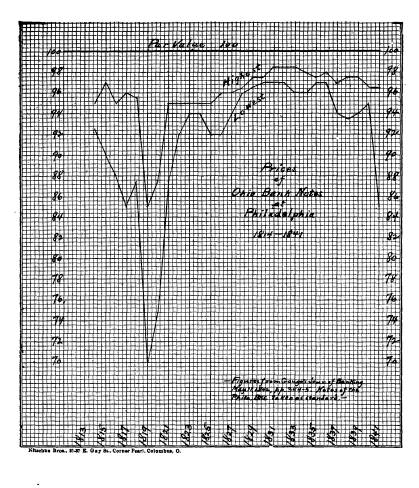

Quotations of Ohio

bank notes at Philadelphia ..................... 487

Diagram showing above,

from 1814 to 1841 ........................ 492

Receipts from public

land sales in the United States each year,

1796 to

1841.................................................. 493

Distribution of real

estate loans of the Ohio Life Insurance &

Trust Co., by counties

in Ohio, 1836 .......................... 494

Digest of General

Banking Law of Feb. 24, 1845 ................... 495

Digest of Free Banking

Law of March 21, 1851 .................... 499

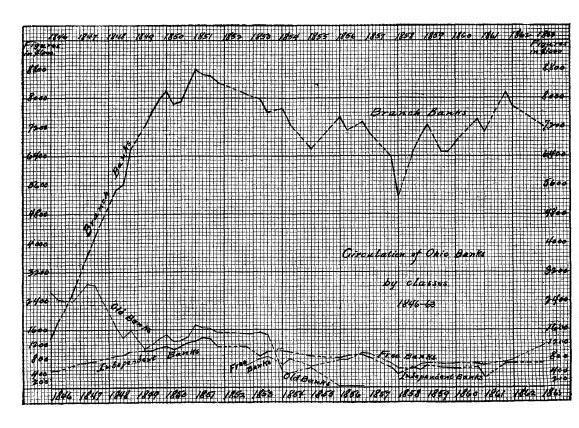

Diagram showing

circulation of different classes of Ohio banks from

1846 to

1863.................................................. 502

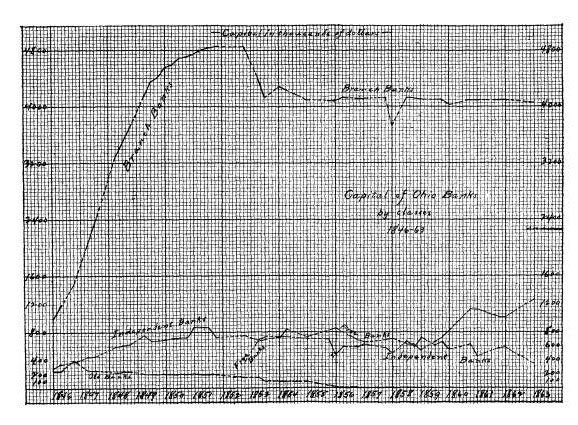

Diagram showing

capital of different classes of Ohio banks from

1846 to

1863 .................................................. 503

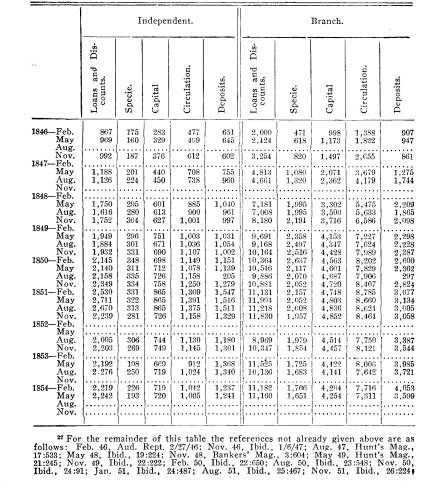

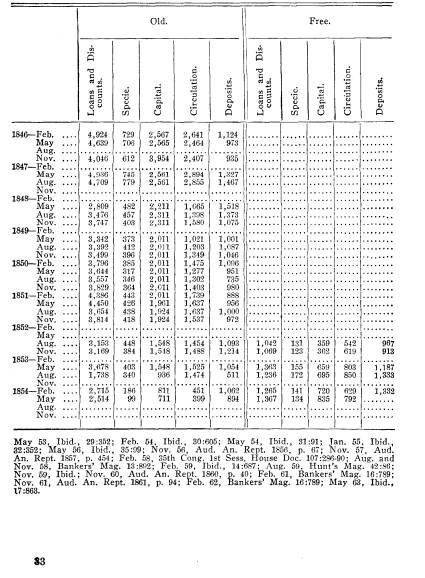

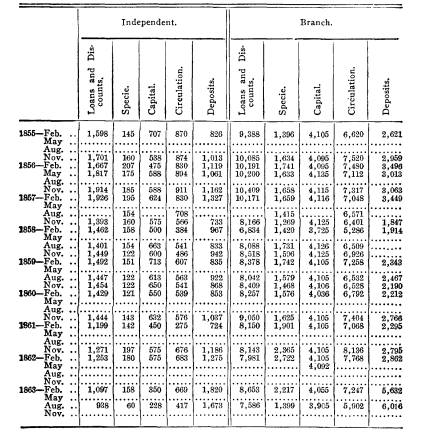

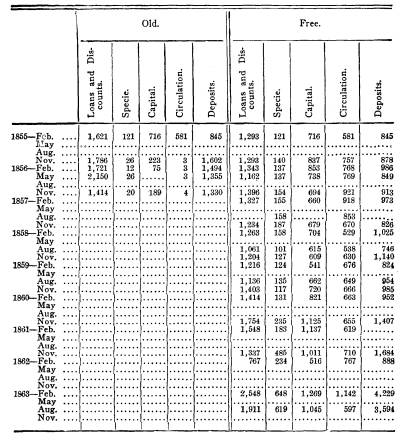

Statistical tables

showing detailed resources and liabilities of each

class of Ohio

banks, 1846-1863 ................................ 504

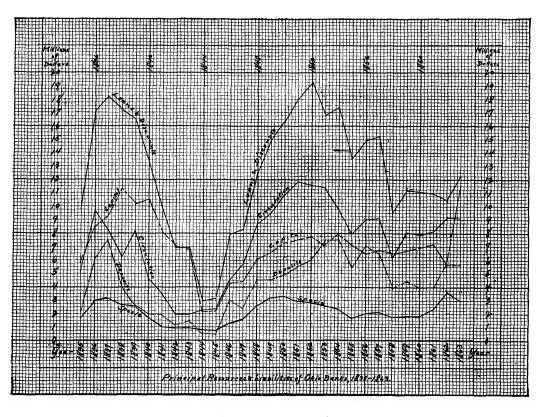

Diagram showing

capital, circulation, loans, deposits, and specie of

Ohio banks

from 1835 to

1863 ................................

511

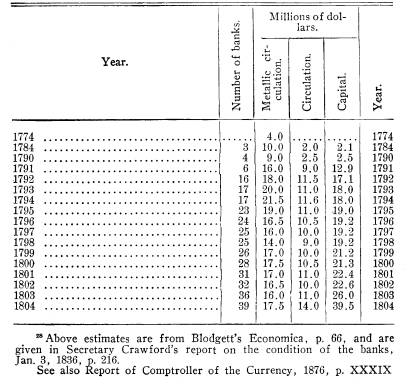

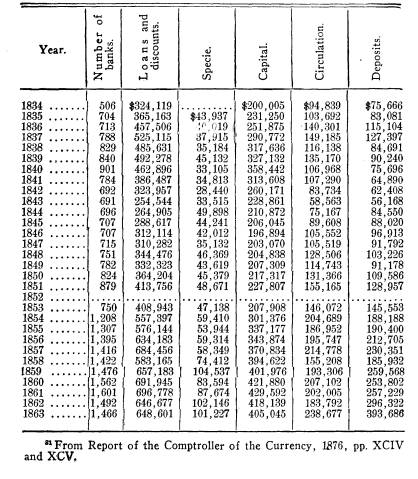

Statistics of state

banks in the United States, 1784-1863 ............ 516

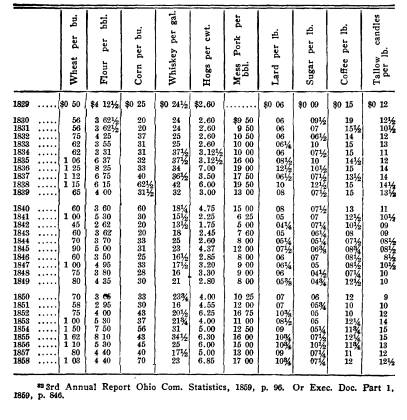

Table showing December

prices of certain commodities at Cincin-

nati, 1829-59

................................................ 519

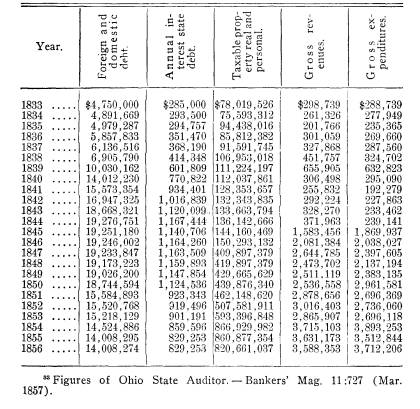

Table showing

principal and interest of Ohio state debt, value of

taxable property in

the state, and gross state revenues and ex-

penditures each year,

from 1833 to 1856 ...................... 520

Table showing profits

of each stock bank and each branch of State Bank 521

Financial statement of

the Bank of the Ohio Valley, May 6, 1862... 523

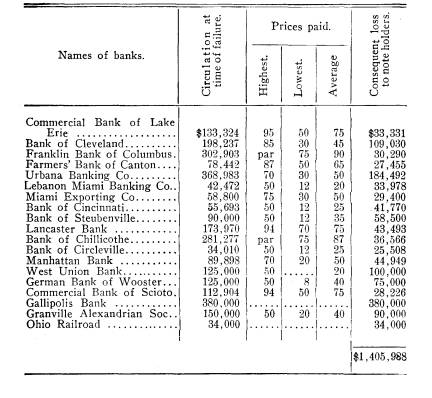

Depreciation of notes

of Ohio banks that failed, 1831-43............ 524

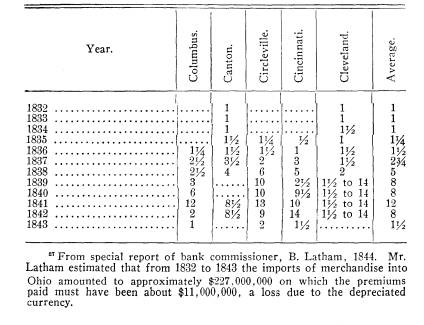

Premium on exchange at

certain Ohio towns, 1832-43 .............. 525

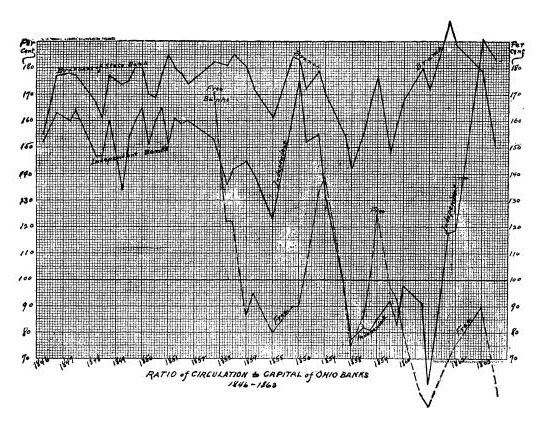

Diagram showing ratio

of circulation to capital for safety fund

and stock

banks .............................................. 526

BIBLIOGRAPHY

................................................ 527

INDEX

.......................................................... 534

|

|

|

(244) |

GEOGRAPHY AND EARLY HISTORY OF OHIO,

Boundaries and Drainage.-The State of Ohio has an

area of 41,240 square miles.* Its

longest east and west measure-

ment is 225 miles, and its longest north

and south measurement

210

miles. Extending from the Ohio River to

Lake Erie the state

lies partly in the drainage basin of the

Mississippi River and

partly in that of the St. Lawrence,

about one-fourth of the

state draining into Lake Erie and the

rest into the Ohio. The

principal rivers of the state which flow

into the Ohio are,

naming them from east to west, the

Mahoning, the Muskingum,

the Hocking, the Scioto, the Little

Miami, and the Great Miami,

while the Grand, the Cuyahoga, the

Sandusky, and the Maumee

rivers flow into Lake Erie. Nearly

three-fourths of the north-

ern boundary of Ohio is formed by Lake

Erie, its southern

shore line in Ohio being 220 miles in

extent. All of the southern

and more than half of the eastern

boundaries of the state are

formed by the Ohio, which flows for more

than 436 miles along

the borders of the state.

These waterways have been very important

factors in the

history of Ohio,- influencing the

movements of the early ex-

plorers, and guiding the fur traders and

frontiersmen that fol-

lowed them; deciding the location of the

early settlements, and

determining the distribution of later

population; facilitating the

marketing of surplus products; supplying

water power for mills

and factories; and affording means of

communication between

different parts of the state, as well as

with other parts of the

country.

La Salle and the French Fur Traders. - As

early as 1669

the Frenchman, Joliet, traversed Lake

Erie from west to east,1

while the next year LaSalle is said to

have crossed the region

south of the lake, possibly by way of

the Cuyahoga and Mus-

*Ohio Topographical Survey, 1910, p. 55.

1Cartier to Frontenac--Justin Winsor, p.

218.

(245)

246 Ohio Arch. and Hist.

Society Publications.

kingum portage route, and to have found

the Ohio.2 Thus what

is now Ohio became part of the great

domain of France in Am-

erica. It is said that at the mouth of

the Cuyahoga the French

held a conference with the Five Nations

as early as 1684.3 Soon

after that the French traders were

pushing along the south shore

of Lake Erie and up the valleys of the

Sandusky and the Mau-

mee on their way to the Wabash. No

permanent establishment,

however, was made in or near Ohio during

the remainder of

that century. In 1701 Cadillac

established Detroit as a strategic

point from which to control the fur

trade, and the Maumee, the

Sandusky, and the territory down to the

Ohio became depend-

encies of this center.4

English Trade Rivalry. -At this time the adventurous

traders of the English were already

crossing the Alleghanies

from the seaboard colonies and fixing

their huts along the Ohio.5

By 1725 English traders from Carolina

were trading with the

Miamis on the Wabash,6 and

English trade rivalry among the

tribes of both the Ohio and the Lakes

soon became a serious

matter with the French officials and

merchants.7 The trade

war between the English and the French

for the West continued

during the entire 18th cenutry. They

first struggled for the

possession of strategic points on the

Wabash. This was the

incentive which induced the French to

found Vincennes about

1735.8 Next came another battle for the

Ohio country. Prob-

ably as early as 1730 English traders

from Pennsylvania were

making their way across middle or

southern Ohio.9 From that

time until the middle of the century the

contest was narrowed

2La Salle and the Discovery of the Great West-Francis

Parkman,

p. 22. See also Discovery of America -John

Fiske, Vol. II., p. 532.

3The Ohio Valley in Colonial

Days--Berthold Fernow, p. 40.

4Cooley's Michigan, pp. 16, 18 and 19.

5Cartier to Frontenac-Justin Winsor, p.

364.

6Ohio-Rufus King, pp. 49-51.

7France in America--Reuben Thwaites, p.

91.

8The Wabash Trade Route -Benton,

p. 29; Also Bancroft's History

of the United States, Vol. II., p. 225;

The Mississippi Basin-Winsor,

p, 149; and France in America-Reuben

Thwaites, p. 93.

9 Ohio--Rufus King, pp. 53, 57. Also The

Mississippi Basin--

Winsor, p. 149.

Banking and Currency in Ohio Before

the Civil War. 247

to the region south of Lake Erie.l0

In 1745 English traders

were at Sandusky erecting houses,

perhaps the first English

structures in Ohio.1l In

1748 an English alliance with the Mi-

amis effectually established English

trade on the Wabash, and

the packmen of Pennsylvania and Virginia

pushed boldly into

the Ohio Valley, establishing their most

advanced post that year

at Pickawillany on the Great Miami

River.12 It was estimated

that during a single season at this time

some 300 English traders

were leading their packhorses and

dragging their batteaux over

the mountain passes into the Ohio

Valley.l3

The Inevitable Conflict. - The French looked with great

alarm upon this intrusion of English

packmen into Ohio, which

not only threatened their fur trade in

that region, but endan-

gered the communications between

Louisiana and Canada.14 In

1748 the commandant at Detroit received

instructions to be wary

and, though peace ostensibly existed, to

use force if necessary

to prevent the English getting a

lodgment in the Ohio country.15

The following year Celeron de Bienville

was sent with a strong

force down the Alleghany and Ohio rivers

to take formal pos-

session by burying leaden plates at the

mouths of the chief

streams, and to drive out English

traders. He found traces of

English packmen everywhere, and though

he arrested four, his

report was very discouraging. It was

then that the Governor

of Quebec asked for 10,000 French

peasants to settle the region

before the English should do so.16

The English colonies were already

looking upon the Ohio

Valley as an important outlet to their

growing population. In

1749 the Ohio Company was chartered for

trading and coloniz-

ing purposes west of the mountains, and

the next year it sent

Christopher Gist to explore the Ohio

region. He met many

The Wabash Trade Route-Benton, p. 30.

11The Mississippi Basin - Winsor,

p. 248.

12Ibid, pp. 243 and 249.

13Ibid, p. 249. Also Montcalm and

Wolfe-Parkman, Vol. I. p.43.

14Narrative and Critical History of America-Justin Winsor,

Vol.

V., p. 12.

15The Mississippi Basin-Winsor, p. 249.

16 France in America - Thwaites,

p. 151.

248 Ohio Arch. and Hist.

Society Publications.

Scotch-Irish traders who were operating

in what is now Ohio,

and his favorable report greatly

stimulated English interest in

the West. At once daring Virginia

settlers began moving over

the mountains.17 It was

evident that a collision between the

French and the English could not be

postponed much longer.

In fact the inevitable conflict was at

hand, and there was on

both sides a belief that whoever should

be left in possession of

the Lakes and the Ohio at the close of

the war about to begin

would control the continent.18 Indeed

the Old Northwest, as

Professor Hinsdale says, was "the

occasion of the final struggle

for dominion between France and England

in North America."19

Pontiac's Conspiracy. -Upon the outbreak of the Old

French and Indian War in 1754,

practically all the English trad-

ers and pioneers beyond the mountains

withdrew to the older

settlements. Probably not a British

trader or settler remained

west of the Alleghanies.20 But

after the treaty of Paris in 1763,

which closed the war and transferred

Canada and the great cen-

tral valley east of the Mississippi to

England, the westward

movement of the English began again with

renewed energy.

Not only traders but settlers also at

once began pushing over the

mountains into the Ohio Valley, although

a proclamation of the

king in 1763 had forbidden the English

colonists to attempt to

occupy the region west of the mountains,

which was made crown

lands to be given over to the uses of the

Indians.21

This movement was suddenly checked,

however, by the In-

dians themselves in the Conpiracy of

Pontiac, when that Ot-

tawa chieftain, finding the Indians

fiercely resenting the intrusion

of settlers upon their lands,22 succeeded

in organizing the tribes

of the Lake Region into the most

formidable Indian movement

in American history.23 For

more than a year terror reigned

supreme along the whole English

frontier, and it was only with

17France in America-Thwaites, pp. 152-4.

18The Mississippi Basin-Winsor, p. 336.

19The Old Northwest-B. A. Hinsdale, p.

V.

20France in America-Thwaites, pp. 165

and 181.

21The Western Movement-Winsor, p. 2.

22The Conspiracy of Pontiac-Parkman,

Vol. I., pp. 175 and 176.

23Formation of the Union -A. B. Hart, p.

40.

Banking and Currency in Ohio Before

the Civil War. 249

the greatest difficulty that Pontiac was

beaten. Finally, how-

ever, after winning the bloody battle of

Bushy Run in August,

1764, Col. Henry Bouquet pushed across

the Ohio and pene-

trated the wilderness as far as the

Muskingum River. Here in

October, 1764, he succeeded in making a

treaty with the Indians,

and again the English traders, hunters,

and settlers began to

enter the Ohio country, for at that time

no region in North

America had the reputation of being so

inviting as the Ohio

Valley.24

The Quebec Bill.-To prevent the

fur trade of the

Northwest from slipping away to the

French and Spanish the

English home government desired to

placate the Indians, and

therefore endeavored to restrain the

settlers from crossing the

Ohio.25 This program,

however, was little heeded by the hundreds

of English colonists who were already

entering the Ohio Valley,

and many of whom crossed to the northern

side of the river;

neither did it meet with the approval of

the Colonies themselves,

several of which claimed various

portions of the northwest.

In 1774, largely as a means of

extinguishing all claims of Con-

necticut, Massachusetts, and Virginia to

this region Parliament

passed the Quebec Bill, which annexed to

Quebec the whole

territory between the Ohio and

Mississippi Rivers and the Great

Lakes.26 But just as the

Royal Proclamation of 1763 failed to

prevent the settlers from crossing the

mountains and only served

to anger the Colonies; so the Quebec

Bill not only failed to keep

settlers from crossing the Ohio, but was

seized upon as one of

the grievances justifying the

Revolution.27

The Moravians and the Squatters. -As early as 1772

Zeisberger and his Moravians had crossed

the Ohio, pushed into

the interior, and laid the foundation of

a white settlement in the

valley of the Tuscarawas, one of the

branches of the Mus-

kingum.28 And before the Revolution many pioneer settlements

24The Western Movement -Winsor,

p. 12.

25Ibid, pp. 23 and 25.

26Formation of the Union - Hart, p. 60.

27Formation of the Union - Hart, p. 60.

Also The Old Northwest

-Hinsdale, p. 147. The Western Movement

-Winsor, p. 2.

28 The Western Movement- Winsor,

p. 56. Also King's Ohio, p. 126.

250 Ohio Arch. and Hist.

Society Publications.

had been made on the northern side of

the Ohio as far down

as the mouth of the Muskingum. In 1776

Col. Patterson re-

ported several of these so-called

"tomahawk" improvements be-

low the Hocking, and two years later

they had already extended

for thirty miles up the Muskingum.29

These people were the

subject of frequent complaints by the

Indians, who were de-

termined to preserve their hunting

grounds; and Congress in

September 1783 issued a proclamation

against unauthorized ap-

propriations of the Indian lands; but in

vain, there continued a

steady flow of settlers across the Ohio,

giving the Indians good

reason to suspect the Americans of a

design to encroach upon

their tribal lands.30

Permanent Settlement.-After the close of the Revolu-

tion the fame of the lands along the Ohio spread rapidly

and com-

panies began to be formed for the

purpose of planting colonies

there. In January 1785, at the treaty of

Fort McIntosh the In-

dian title to a large part of the land

between Lake Erie and the

Ohio river was extinguished,31 and

in June 1787 Congress passed

the famous Ordinance of 1787 providing

for the government

of the Northwest Territory.32

A few months later, in October

1787, the Ohio Company, composed largely

of people from

Massachusetts, contracted for the

purchase of about 1,500,000

acres along the Ohio between the Scioto

and Muskingum riv-

ers, and early the following spring they

made what is known

as the first permanent settlement in

Ohio, when, on the seventh

of April, 1788, they founded Marietta at

the mouth of the Mus-

kingum.33 In October of the

same year a company composed

chiefly of New Jersey people contracted

for a large tract of land

between the mouths of the Miamis and in

November 1788 they

founded a town, called Columbia, at the

mouth of the Little Mi-

ami. A month later, about five miles

below this point, a town

was started on the Ohio river just

opposite the mouth of the

29King's Ohio, pp. 191-2.

30 The Western Movement - Winsor, pp.

243-5.

31Historical Collections of Ohio--Henry

Howe, Vol. I., p. 36.

32 Formation of the Union--Hart, p. 108.

33Howe's Historical Collections of Ohio,

Vol. I., pp. 37 and 131. The

Western Movement- Winsor,

pp. 296 and 298.

Banking and Currency in Ohio Before

the Civil War. 251

Licking. This later came to be known as

Cincinnati,34 and was

destined soon to distance its early

rivals in growth of population

and commercial importance. It was not

until after the treaty of

Greenville in 1795, however, that

Cincinnati made much

growth.35

The Treaty of Greenville. - As the settlements north of

the Ohio increased in number and

population the Indians became

more and more uneasy. Hostile bands were

soon hovering about

the Muskingum and Miami settlements, and

before long open

warfare broke out. In 1790 an expedition from Cincinnati led

by General Harmar resulted in failure,

and the following year

Gov. St. Clair's strong force, which

proceeded against the In-

dians on the Maumee, was totally

defeated. Indian outrages of

all kinds increased until immigration

north of the Ohio almost

ceased. Finally, however, in 1794 an

army under Gen. Anthony

Wayne inflicted a severe defeat upon the

Indians at the rapids

of the Maumee after which Wayne burned

many of their vil-

lages, laid yaste their cornfields for

miles, and erected Fort De-

fiance in the heart of their country.36

This brought the Indians

to terms, and at Greenville in 1795

eleven of the most powerful

tribes of the Northwest made a treaty

with Gen. Wayne, which

confirmed the boundary line fixed at the

treaty of Fort McIn-

tosh. This opened all of Ohio to white

settlement except the

northwestern part.

Admission to Statehood.--During

the next few years

following the treaty of Greenville in

1795 a wave of settlers began

to pour into the territory. Population,

hitherto confined chiefly

to the vicinity of the Ohio, began to

diverge from Marietta on

the one hand and Cincinnati on the

other, towards the height of

land between the Ohio and Lake Erie.

Naturally the river

valleys were the first to become

populous. Soon permanent set-

tlers were occupying the valleys of the

Muskingum, the Hocking,

the Scioto, and the Miamis, and a range

of towns across the

country north of the early settlements

marked the progress of

34 Howe's Historical Collections of

Ohio, Vol. I, pp. 38 and 747. The

Western Movement-Winsor, p. 315.

35 King's Ohio, p. 215.

36Howe's Historical Collections of Ohio,

Vol. I., p. 40.

252 Ohio Arch. and Hist.

Society Publications.

population.37 In the Miami

Valley, Hamilton was laid out in

1794, Dayton in 1796, and

Springfield in 1801. On the Scioto,

Chillicothe was laid out in 1796, and

the next year Franklinton,

where Columbus now stands. Athens on the

Hocking was set-

tled in 1797 and Lancaster in 1800. While in the Muskingum

Valley, Zanesville was begun in 1799 and

Coshocton in 1802.38

Meanwhile Cleveland had been founded on

Lake Erie at the

mouth of the Cuyahoga in 1796,39 and

Steubenville on the upper

Ohio in 1798.40 Thus the great outlines of the future state

so

rapidly filfiled with inhabitants that

on April 30, 1802 Congress

passed an act enabling the portion of

the Northwest Territory

between Lake Erie and the Ohio River to

form a state.41 A con-

vention assembled at Chillicothe in

November 1802 and adopted

a Constitution,42 and an act

of Congress approved April 15,

1803 recognized the State of Ohio.43

37King's Ohio, p. 264.

38 Howe's Historical Collections

of Ohio, Vol. I., pp. 342, 396, 466

and 589; Vol. II., pp. 274 and 492.

39 The Western Movement--Winsor, pp.

502-4.

40Howe's

Hist. Coll. of Ohio, Vol. I., p. 964.

41Charters and Constitutions--Ben Perley

Poore, Vol. II., p. 1453.

42Ibid, p. 1455.

Ibid, p. 1464.

PART I. BANKING IN OHIO UNDER

SPECIAL CHARTERS. 1803-1843.

NOTE ISSUE BASED ON GENERAL

ASSETS.

(253)

CHAPTER 1.

THE ANTE-INFLATION PERIOD. 1803-1814.

Economic Conditions. - During the period preceding the

War of 1812 the people of Ohio were

occupied literally in get-

ting out of the woods. Dense forests

separated the different

settlements, delaying the social and

economic fusion of the

population. The barrier of the

Alleghanies cut them off from

the markets of the Atlantic States

except for live stock, which

could be driven over the mountains on

foot. Consequently the

occupations of the people were mainly

pastoral or agricultural.

Yet the very barriers which made it hard

to dispose of surplus

products and difficult and costly to

import merchandise, etc.,

served to hasten home manufacturers. The

towns on the Ohio

and its tributaries had the advantages

of river communication

with each other as well as with

Pittsburg, Louisville, and New

Orleans, and it was in these centers

that manufacture and com-

merce first developed in Ohio. Here also

naturally the first

banks operated in the state were

organized. It is noteworthy

that of the eight authorized banks

organized in Ohio during

this period all were located in towns

situated either on the Ohio

or its tributaries.

Early Manufacturing.- In the early development of

manufacturing in Ohio the natural

resources of the state were of

great advantage. The hard woods of the

forests were utilized

from the beginning. Desks, tables, and

other furniture were

being manufactured in Cincinnati as

early as 1800, and a few

years later plow-making became an

important industry there.1

Before steam navigation began on the

Ohio in 1811, Marietta

was quite a ship building point, sending

to sea, it is said, before

the War of 1812, seven ships, eleven

brigs, six schooners, and

two gun boats.2

1Ohio Manufactures - 12th Census

Bulletin 154, pp. 10 and 11.

2King's Ohio, p. 308.

(255)

256 Ohio Arch. and Hist. Society Publications.

In 1804 the first furnace for the

manufacture of iron in

Ohio was established in the Mahoning

Valley.3 And in 1805 a

paper mill was built on Little Beaver

Creek in the eastern part

of the state.4

Zanesville, with its falls giving water

power, soon developed

manufacturing.5 The abundance of clay

suitable for making

coarse pottery and the difficulty of

obtaining such products from

the Atlantic Coast region early led the

farmers of the Mus-

kingum region to begin the manufacture

of pottery from the

clay on their farms to supply the

settlements west of the Alle-

ghanies. These products were sent down

the Muskingum to

markets on the Ohio River and even to

New Orleans.6

Every year at the opening freshets,

large quantities of flour,

bacon, pork, whiskey and the fruits of

the country adjacent to

the streams were taken in flat boats to

New Orleans and the

intermediate markets. The starting of

these fleets every year

was a spectacle of great interest at the

towns on the Muskingum,

the Scioto, and the Miami.7

Besides the towns mentioned above,

Steubenville, Lancaster,

Chillicothe, and Dayton were important

towns for manufactures

in those days. In 1810 the manufactures

of the state were es-

timated to amount to nearly $2,000,000,8

but they were chiefly

in the southern part of the state. The

northwest was still Indian

country, while the northeast in general

did not acquire much

commercial importance until the opening

of the Erie Canal and

the beginning of the Ohio Canal in 1825,

although Warren and

Youngstown both on the Mahoning River,

early became import-

ant towns from their proximity to

Pittsburg and their location

on the trade route from there to

Detroit.

The Miami Country. -The most populous and flourish-

ing part of the state at that time was

at the southwest, in the

broad and fertile expanse of the Miami

Valley. With this im-

3Ohio Manufactures-12th Census Bulletin

154, p. 7.

4Ibid, p. 11.

5King's Ohio, p. 339.

6Location of Industries-12th Census

Bulletin 244, p. 18.

7King's Ohio, p. 307.

8Valley of the Mississippi-Timothy

Flint, p. 406.

Banking and Currency in Ohio Before

the Civil War. 257

mense agricultural back country and its

advantageous location on

the Ohio River apposite the mouth of the

Licking River, Cincin-

nati easily gained an ascendancy which

made it the leading city

in the West for many years.

In 1790 the population of the Miami

Country was not over

2,000. In 1800 it was about

15,000. In 1810 the single county

of Hamilton contained 15,258, and the

Miami Country about

70,000, or one-fourth of the whole

population of the state. By

1815 this had increased to about

100,000.9 In this important

region agriculture and stock raising

advanced rapidly. The

fertile soil produced immense crops of

wheat and corn, and

scores of grist mills turned the wheat

into flour. The corn was

utilized largely in feeding hogs, though

many distilleries flour-

ished throughout the region, where the

farmers turned their

surplus corn into whiskey. Much of this

whiskey and flour, to-

gether with the pork, bacon, and lard

prepared on the farms in

winter, found its way to Cincinnati,

there to be shipped by the

Ohio and Mississippi rivers to New

Orleans. As early as 1803

whiskey, beef and pork, and lumber and

staves were shipped

from Cincinnati to New Orleans by water.10

It was in connec-

tion with this river traffic of

Cincinnati that the first bank in

Ohio was organized.

The

Miami Exporting Company.-The enterprising

citizens of the Miami Country were quick

to recognize the advan-

tages of association under state

authority in the transaction of

business. Almost as soon as the State of

Ohio was admitted

into the Union, Martin Baum, a prominent

Cincinnati mer-

chant,11 with several of his business

associates, organized a com-

9Picture of Cincinnati (1815)--Drake, p.

169.

10 Ohio Manufactures -12th Census

Bulletin, No. 154, pp. 8 and 9.

The distillation of liquors in Ohio has

always been greatest at Cincinnati,

where it is favored by the large corn

production of Ohio, Kentucky, and

Indiana. In 1810, however, distilleries

were reported in every one of the

36 counties of the state, producing in

all 1,212,266 gallons of whiskey.-

12th Census Bulletin, No. 154, p. 8.

12The Inquisitor and Cincinnati

Advertiser, Oct. 19, 1819. Martin

Baum, of high German parentage, early

became active in manufacture

and trade in Cincinnati and was most

influential in attracting German

immigration to that city.

17

258 Ohio Arch. and Hist. Society Publications.

pany to facilitate trade, and applied to

the Legislature for a

charter. As a result the State Legislature at its first session

incorporated The Miami Exporting

Company on April 15,

1803.12 The original object

of this company was the exporta-

tion of agricultural produce, chiefly to

New Orleans,13 and bank-

ing, if purposed at all, was a secondary

consideration.14 Its

charter, however, permitted the issue of

notes payable to bearer

and assignable by delivery only; and the

company, which began

business operation in 1804, was soon

exercising the powers of

banking.15 It issued bills and redeemed them, not

in specie,

but in the notes of other banks.16 Thus the Miami Exporting

Company became the first bank in Ohio,

and perhaps the second

west of the Alleghanies.

The first paper-issuing institution west

of the mountains,

the Lexington Insurance Company

incorporated in 1802, is said

to have obtained banking privileges

surreptitiously. And Gouge

in his history of early banking in the

United States suggests

that, as the title of the Miami

Exporting Company indicates that

it was established ostensibly for

commercial purposes of another

nature, perhaps banking privileges were

obtained for it sur-

reptitiously, as in the case of the

Lexington Insurance Com-

pany the year before.17 Be

this as it may, the Miami Exporting

Company almost from the first did a

banking business, opening

an office in Cincinnati for that express

purpose. In fact on

March 1, 1807 the bank went

into full operation, all commercial

projects having previously been

relinquished.18

12Laws of Ohio, Vol. I. (1803), pp.

126-136.

13A Picture of Cincinnati-Daniel Drake

(1815), p. 150.

14 Banking and Resources of Ohio--Thomas

H. Wilson. (In

World's Congress of Bankers and

Financiers), p. 533.

15Laws of Ohio, Vol. I. (1803), p. 135,

Sec. 16. Report of Judiciary

Committee, Jan. 7, 1837, on the

resolution of inquiry into the authority

by which the Miami Exporting Company

exercised the powers of a bank-

ing corporation. - Ohio H. R.

Jour. 1837, pp. 188-195.

16History of Banking-J. J. Knox, p. 668.

17A Short History of Paper Money and

Banking in the United

States-Wm. Gouge (Cobbett's Ed.), p. 88.

18 Picture of Cincinnati in 1815-

Drake, p. 150.

Banking and Currency in Ohio Before

the Civil War. 259

The charter of the Miami Exporting

Company was granted

for a period of forty years, and

provided for a board of eleven

directors, who were to be chosen

annually and one of whom

was to be elected president. The

authorized capital stock of the

company was fixed at $500,000, divided

into shares of $100

each, payable $5 in cash at the time of

subscribing, and $45 in

produce and manufactures such as the

president and directors

would receive during the first year, and

the remaining $50 in

produce and manufactures from July to

March of the follow-

ing year. The stockholders were to give notice in writing

at the Company's office on or before the

first day of September

following, what kind of produce and

manufactures and the prob-

able amount thereof they would deliver,

but the president and

directors were to designate the times

and places of delivery.19

Not all of the authorized capital was

ever paid in. Gouge

gives the capital of this company as

$200,000,20 and this agrees

with the amount stated in the list of

Ohio banks organized be-

fore 1812 published in the first issue

of the Bankers' Magazine.21

In 1811, however, the directors

authorized the sale of a large

number of additional shares of the

capital stock of the company,

and November 28 of that year they issued

a notice offering these

to purchasers with the privilege of

taking them either at $102,

to be paid at the time of subscribing,

or at $104, to be paid one-

fourth at the time of subscribing,

one-fourth in six months, one-

fourth in twelve months, and the

remaining one-fourth when re-

quired by the board, the subscribers,

however, to have at least

thirty days' notice.22 And

Daniel Drake, writing in 1815, says

that the capital consisted of $450,000

paid in by 190 persons, the

number of stockholders at that time.23

It is probable, however, that not all of

this $450,000 was

ever actually paid in cash. It was a

common practice among

19Banking and Resources of Ohio-Wilson,

p. 534. Report of the

U. S. Comptroller of the Currency, 1876,

p. XXV. History of Banking

in the U. S.- H. F. Baker (In Bank

M.11:165 Sept. '56)

20A Short History of Paper Money and

Banking-Wm. Gouge

(Cobbett's Edition), p. 88.

21Bankers' Magazine, Vol. 1., p. 119.

22The Ohio Centinel, Dayton, Ohio, Jan.

9, 1812.

Picture of Cincinnati (1815) -Drake, p.

150.

260 Ohio Arch. and Hist. Society Publications.

banks of the period following the War of

1812 to accept what

were known as stock notes in payment of

subscriptions for

stock; that is, after making the first

payment or two in cash, the

subscriber would be permitted to pay the

remainder of his sub-

scription with his own note, which would

later be redeemed, if

at all, with dividends received from the

bank.24 It is likely that

a considerable portion of the Miami

Exporting Company's $450,-

ooo capital stock was paid in

that way, especially the later issues

of that stock. A published balance sheet

of the company under

date of May 11, 1821 gives the amount of

money paid by the

stockholders on their shares as $379,178.25

The Miami Exporting Company continued in

the undis-

turbed employment of its banking powers

without question until

1822,

when it became unable to progress with its

business. From

that time until 1834 it engaged in no

business but such as was

required for adjusting and closing its

debts and credits and

maintaining its corporate organization.

In 1834, however, it was

resuscitated, and provision was made for

the payment of its

stock, the liquidation of its debts, and

the redemption of its

outstanding notes.26 It

then recommenced the business of bank-

ing, but was finally compelled to wind

up its affairs before the

termination of its charter in 1843.27

The Bank of Marietta. -While the Miami Exporting

Company was the first to exercise the

powers of banking in Ohio,

and continued to do a banking business

for many years, yet, as

we have seen, it was not originally

chartered as a bank, properly

speaking. The first regular bank

incorporated in Ohio was es-

tablished at Marietta. It is not known

just when it began busi-

ness, but its application for a charter

in February 1808 indicates

that it was already an existing

association.28 A charter was

24Report of Sec'y of Treas. Wm. H.

Crawford, Feb. 12, 1820.

25Liberty Hall and Cincinnati Gazette,

May 12, 1821. Gallatin in

1831 listed, among the banks which had

failed since 1811, the Miami Ex-

porting Company with a capital stock of

$468,966. See p. 132.

26Ohio House Journal, 1837, pp. 189-191.

27The Miami Exporting Company failed

Jan. 10, 1842-Knox's

History of Banking, p. 676.

28A History of Banking in all the

Leading Nations, Vol. I., p. 59.

Banking and Currency in Ohio Before

the Civil War. 261

granted to the Bank of Marietta on

February 10, 1808.29 The

main provisions of the law incorporating

this bank were the

following:

1. Charter to continue until 1818.

2. Capital stock not to exceed 5,000 shares of $100 each.

3. Directors seven in number, to be

elected annually by the

stockholders voting in person or by

proxy in proportion to num-

ber of shares held. Directors must be

stockholders and resi-

dents of the county. Vacancies to be

filled by election by re-

maining directors.

4. General meeting of the stockholders

at the call of the

directors, but six weeks' notice must be

given in some newspaper.

5. Stock transferable on the books of

the company if

holder's debts to the bank be paid

first.

6. Bank bills obligatory and of credit

assignable by en-

dorsement.

7. Power to hold real estate for

convenient transaction of

its business; also bona fide mortgages

and property conveyed for

a debt.

8. Trading in merchandise forbidden.

9. Debts must not exceed three times its

capital stock.

10. Interest allowed on loans not over

6%.

11. State could subscribe up to

one-fifth of the capital

stock.

It will be noticed from the above that

while a limit was

fixed to the amount of capital stock

that could be issued, restric-

tions placed on the transfer of that

stock and on the holding of

real estate, and limitations specified

as to debts contracted and

interest rates charged, yet no

restriction appears as to note

issue and no provision as to note

redemption. The evils of

unrestricted note issue had not yet

become apparent to the Ohio

Legislature.

The Bank of Chillicothe.-On Feb. 18, 1808, a week

after incorporating the Bank of

Marietta, the State Legislature

chartered the Bank of Chillicothe with a

capital of $100,000.30

29Laws of Ohio, Vol. VI. (1808), p. 41.

30Laws of Ohio, Vol. VI., p. 83. This

capital stock could be in-

creased to $500,000 by a two-thirds vote

of the stockholders.

262 Ohio Arch. and Hist.

Society Publications.

This bank was located at the town of

Chillicothe and the pro-

visions of its charter were much the

same as those of the Bank

of Marietta, except that the shares of

capital stock were pay-

able one-tenth when subscribed and

one-tenth at the end of

each calendar month thereafter until all

were paid, and that no

person, firm, or company could hold over

forty shares, nor sub-

scribe for more than five shares in one

day.31

Another clause of the charter provided

that the bank

should not emit notes payable in bills

of credit of the state of

Ohio. Here we see an early attempt of

the legislature to regu-

late to some extent the redemption of

the notes issued by the

bank. In those days specie was a scarce

article in Ohio, and the

State Treasury was at times in an

embarrassed situation for

funds to meet the incidental expenses of

the state government.

Sometime before this an act had been

passed by the legislature

requiring the auditor of the state to

issue bills of specific

amounts payable at the treasury with

interest. These had as-

sisted in upholding the credit of the

state and created a kind of

circulating medium which in some degree

supplied the place of

specie.32 Apparently the banks were taking advantage of these

bills to use instead of specie in

redeeming their notes.

The Bank of Steubenville.-Attention has already been

called to the influence exerted by river

valleys in determining

the location of Ohio's early population

and the growth of its

early trade centers. And it will be

noticed that of the three

banks already mentioned, the first was

in the Miami Valley, the

second at the mouth of the Muskingum,

and the third on the

Scioto, the three principal tributaries

of the Ohio in the state.

The fourth bank chartered in the state

was established at Steu-

benville on the upper course of the Ohio

River itself.

The Bank of Steubenville was chartered

by the State Legis-

lature on February 15, 1809 with an

authorized capital stock of

$100,000.33 The number of

directors was fixed at nine, but they

31 The number of

directors was increased from seven to nine by an

act of the legislature on Dec. 31,

1808-Laws of Ohio, Vol. VII., p. 68.

32Auditor's Report, Dec. 4, 1811-Laws of

Ohio, Vol. X. (1812).

Also Auditor's Report of Dec. 9, 1812,

p. 4.

33Laws of Ohio, Vol. VII. (1809), p.

169.

Banking and Currency in Ohio Before

the Civil War. 263

were allowed no pay unless it was

allowed by a general meeting

of the stockholders. Stockholders were

allowed one vote for

each share under ten, one for each two

shares above ten up to

fifty, one for every five shares above

fifty and up to one hun-

dred, and one vote for every ten shares

held over one hundred.

Stockholders resident in the United

States were allowed to vote

by proxy. After the first election,

shares had to be held three

months before the owner could vote. This

charter contained

a provision allowing the State to

acquire stock in the bank, and

provided that when the State should own

shares equal in num-

ber to one-tenth of the whole it should

have the privilege of

appointing two of the directors. If the

State should own less

than one-tenth of the shares, however,

it was to have proxy to

vote as the other stockholders.

Other Banks Chartered.-After the

Bank of Steuben-

ville in 1809 no more banks were

chartered in Ohio until 1812. In

1811, however, the charter of the United

States Bank expired

and Congress refused to recharter it.

This left the field free

for State banks, and they were not slow

to take advantage of

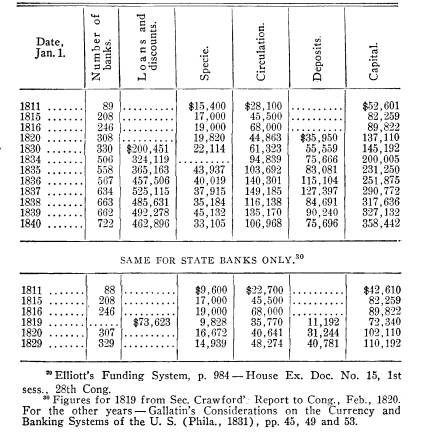

the opportunity.34 From

January 1, 1811 to the close of 1814

the number of banks in the United States

increased from 88 to

208, and

their capital stock from $42,61O,601 to $82,259,590,

making an addition of nearly

$30,000,000, to the banking capital

of the country.35

In Ohio this movement became apparent at

once. Several

unauthorized banks were established

within the state during

1811, and, as we have already seen, the

Miami Exporting Com-

pany issued a large additional amount of

capital stock, which

was eagerly taken by the public, though

it was offered only at

a premium.36 Early in 1812

two more banks were chartered by

the Ohio Legislature. A third was

incorporated in 1813, and

34Financial History of the United

States-Davis R. Dewey, p. 144.

Banks, Banking and Paper Currencies-

Hildreth, p. 64.

35 Report of U. S. Comptroller of the

Currency, 1876, p. XXXV.

Elliot's Funding System, p. 984-House

Exec. Doc. No. 15, 1st

Session 28th Congress. Considerations on

the Banking and Currency

System of the United States-Albert

Gallatin (1831), pp. 42 and 44.

36See page 259.

264 Ohio Arch. and

Hist. Society Publications.

another in 1814. Thus from 1811 to 1814 the number of in-

corporated banks in Ohio doubled. During

the same period

their capital stock increased from

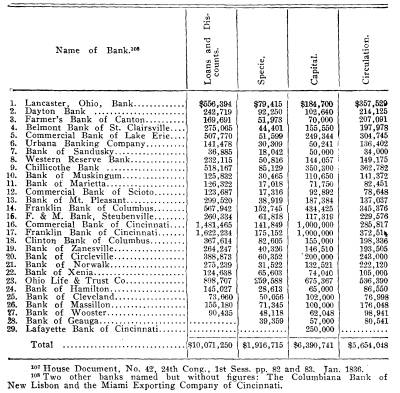

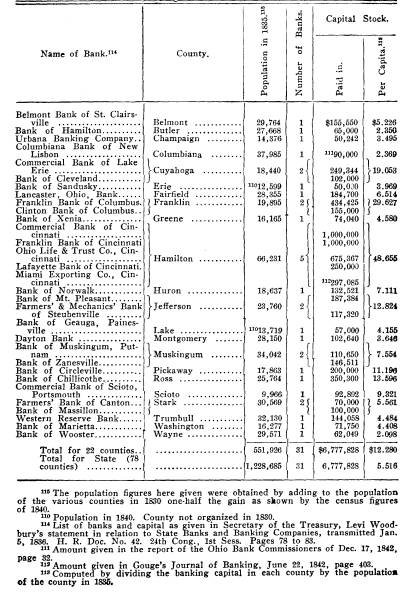

$895,000 to $1,435,819.37

The names of the new banks chartered in

Ohio from 1812

to 1814, together with their location,

authorized capital stock,

and dates of charter are shown in the

following:

Name. Location.

Capital Stock. Chartered.

1. Western Reserve Bank.. Warren

........ $100,000 ..Feb. 20, 1812.38

2. Bank of Muskingum.... Zanesville

..... 100,000 ..Feb. 21, 1812.39

3. Farmers' & Mechanics'

Bank

................ Cincinnati

..... 200,000 ..Feb.

5, 1813.40

4. Dayton

Manufacturing

Co.

.................. Dayton

........ 100,000 ..Feb.

11, 1814.41

These banks were all chartered by

special acts of the legis-

lature, and their charters all extended

until 1818. The methods

of their organization were about the

same, and the provisions

of their charters were quite similar.

The number of directors

varied from seven to thirteen. The

charter of the Farmers' and

Mechanics' Bank contained a provision

which required that one-

third of the thirteen directors must be

practical farmers and the

same proportion practical mechanics.42

In the case of the Bank of Muskingum

occurs apparently

the first attempt of the legislature to

prevent the paying of divi-

dends to stockholders who had not yet

paid in all their stock,

a clause in that charter providing that

persons failing to pay up

installments should not be entitled to

any dividend. In the

charter of this bank also we see the

first of the endeavors of

the legislature to restrict note issue,

as another clause of the

charter prohibited the bank from issuing

bills to a greater

37 Report of the U. S. Comptroller of

the Currency, 1876, p. LXXXV.

Report of U. S. Sec'y of Treas. Wm. H.

Crawford, Feb. 12, 1820.-

In Elliot's Funding System, p. 769.

38Local Laws of Ohio, Vol. X. (1812), p.

111.

39Laws of Ohio, Vol. X. (1812), p. 40.

40Laws of Ohio, Vol. XI. (1813), p. 79.

41Laws of Ohio, Vol. XII. (1814), p.

162.

42Laws of Ohio, Vol. XI. (1813), p. 81.

Picture of Cincinnati in

1815-Drake, p. 151.

Banking and Currency in Ohio Before

the Civil War. 265

amount than three times the amount of

capital stock paid in, and

made the directors individually liable

for any excess above that

amount. It was also provided in this

charter that the legislature

might tax the capital stock of the bank.43

Unauthorized Banking.-In addition to the foregoing

banks incorporated by the State

Legislature before 1815, there

were various other concerns in Ohio

carrying on banking business

without charters. In 1807 a company

known as the Alexandrian

Society of Granville had been chartered

by the legislature for

literary purposes.44 It later

engaged in the business of banking,

though no such privilege was granted in

its charter.

A bank was opened at Delaware as early

as 1812, but fail-

ing to get a charter the next winter it

wound up its affairs, re-

deeming all its notes. During the same

year a swindling con-

cern called the Scioto Exporting Company

was started in this

town by a gang of counterfeiters. It was

destroyed by the citi-

zens, however, before it could get a

large amount of paper

afloat.45 Various other

unincorporated banks were established

in the state after the expiration of the

charter of the first United

States Bank in 1811, some of which were

quite successful.46

Several of the chartered banks had

existed for some time

as unauthorized banks before applying

for charters, as in the

case of the Bank of Marietta. Thus, too,

the Farmers' and

Mechanics' Bank had been established in

1812, the year before

it was incorporated.47 Quite a number also of unauthorized

banks existed during the latter part of

this period which were

later given charters by the legislature

in 1816. Thus the Zanes-

ville Canal and Manufacturing Company,

which was chartered

in 1816, was originally organized in

1812 to build a dam across

the Muskingum River and for

manufacturing and other pur-

poses.48 It later exercised

banking powers, however, and was

probably the bank referred to by Dr.

John Cotton when he vis-

43Laws of Ohio, Vol. X. (1812), pp.

40-51.

44Laws of Ohio, Vol. V. (1807), p. 62.

45Howe's Historical Collections of Ohio,

Vol. I., p. 553.

46 See page 263.

47Picture of Cincinnati in 1815- Drake,

p. 151.

48Laws of Ohio, Vol. XIV. (1816), p.

293.

266 Ohio Arch. and Hist.

Society Publications.

ited Zanesville in 1815 and found an

"active enterprising popula-

tion of two or three hundred busy in

digging a short canal

through rock for water power and

factories, to pay the expense

of which a private bank was issuing

bills which were in good

credit".49 Another

unauthorized concern, the Bank of Cincin-

nati, was founded in 1814, with shares

at $50 each, 8,800 of

which had been sold to 345 persons by

1815, though it had not

yet obtained a charter. It was governed

by twelve directors

chosen annually. Its notes in 1815 were

in excellent credit and

the dividends had advanced from 6 to 8%